Pokemon Plushies and $130K Renovations

The difference between Money Out and Money Sideways

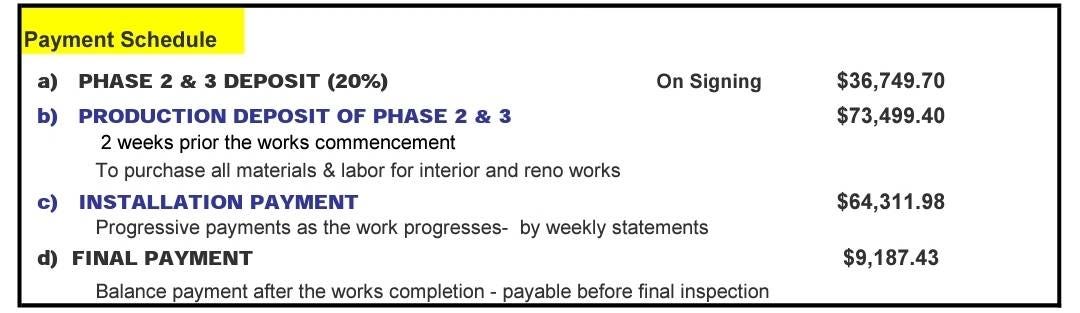

On Sunday, my friend was fretting about needing to come up with a bit more cash to cover her $100,000+ home renovation project.

While she worried that she didn’t have enough cash to cover the renovations, I noted unhelpfully that she’s not spending money—she’s just moving it from one pocket to another1.

What I mean is, this is not an EXPENSE. It’s an ASSET.

When she spends money on home improvement in a major real estate market like hers, she is not moving MONEY OUT of her personal finances. She is moving MONEY SIDEWAYS.

She’s moving money from one of her Pockets, which is CASH, to another of her Pockets, Which is HOME VALUE.

Later, my other friend was ashamed but excited to have spent $270 (+ shipping) to acquire an entire set of rare Pokemon Plush stuffed animals, all so she could get hold of the one “Eevee” plush that she wanted from the set.

I had to ask her a question to know whether this purchase of Eevee and friends was MONEY OUT or MONEY SIDEWAYS in her personal finances. In other words: Will the price of these plushies continue to rise or not?

She said that the price would certainly rise.

Since she is an expert on cute toys, and I know she knows her stuff, we can trust that this is true. That means she has moved MONEY SIDEWAYS. She has moved it from one Pocket, which is CASH, to another Pocket, which is POKEMON PLUSHIES.

The value of the money is still in one of her pockets. It is just in the form of Charizard and Eevee now. Since each of these plushies is worth an average of about $37.50, she can think of them as two cute, soft, pastel-colored $20 bills that take up a lot more space than $20 bills.

MONEY SIDEWAYS. Moving it from one of your pockets, like CASH, to another Pocket, like PLUSHIES.

In your business, this might be like buying a $2700 computer or a $1200 Barbering Chair. But it is also like moving $600 from one pile of spendable money to another, like from your Savings Account to your Checking Account, or from your Checking Account to your Credit Card Account.

Meanwhile, MONEY OUT is like moving money from one of your Pockets of spendable money to someone else’s Pocket—like from your Checking Account to theirs, in exchange for CANDY.

In your business, this might be like using your Credit Card to pay Google for clicks, or using your Checking Account to pay a copywriter to write for your client.

So when you do Everything Every Week, you do your bookkeeping not in order of date or of account, but in order of Money Flow—starting with MONEY SIDEWAYS.

DOING MONEY SIDEWAYS: Find the pockets that it moved between, and match them up.

Need help? Join my Weekly Office Hours along with other subscribers and Ask Me Anything!

This is where 80% of mistakes happen in bookkeeping. People accidentally treat Money Sideways as if it is Money In or Out. Don’t do that.